kaufman county tax rates

The minimum convenience fee for credit cards is 100. Mud4 kaufman county mud 11 0410000 0590000 1000000 mud5 kaufman county mud 12 na na na mud6 kaufman county mud 5 0067500 0932500 1000000 mud7 kaufman county mud 6 0082500 0817500 0900000 mud8 kaufman county mud 7 0187500 0712500 0900000 mud9 lake vista mud 9 na na na mud4a las lomas mud 4a 1000000 0000000.

Tax Information Independence Title

Effective tax rate Kaufman County 00189 of Asessed Home Value Texas 00180 of Asessed Home Value National.

. Request for Electronic Communications. KAUFMAN COUNTY TAX OFFICE PO. Sarah curtis created date.

Watch here for budget details and interesting stories of how your tax dollars are used to improve the quality of life in Kaufman County. The median property tax on a 13000000 house is 260000 in Kaufman County. 1062020 82012 am.

To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044. Start Your Homeowner Search Today. The tax rate was lowered by 867 percent from 504957 to 461171 per 100 valuation.

BOX 339 KAUFMAN TEXAS 75142. Whether you are already a resident or just considering moving to Kaufman County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing.

The median property tax on a 13000000 house is 136500 in the United States. Use UpDown Arrow keys to increase or decrease volume. Kaufman County Courthouse 100 W.

Use UpDown Arrow keys to increase or decrease volume. The county property tax rate has gone down from 5887 in 2019 to 4612 in 2022 a decrease of 12 cents or 216 percent. Ad Compare Your 2022 Tax Bracket vs.

There is a fee of 150 for all eChecks. Search Valuable Data On A Property. 2020 Certificate of Obligation KaufmanCO20 0 20 20086 0 20 20086 Kaufman Tax Note Series 2020 6000000 1921000 35000 7956000 expand as needed N otice of Tax Rates Form 50-212 F o r a d d itio n a l co p ie s visit.

Kaufman County Tax Office Locations. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. Kaufman County Courthouse Annex 100 N.

Tax Rates By City in Kaufman County Texas The total sales tax rate in any given location. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. Kaufman County Entities Freeport Exemptions.

Learn all about Kaufman County real estate tax. Such As Deeds Liens Property Tax More. Explore the charts below for quick facts on Kaufman County effective tax rates median real estate taxes paid home values income levels and homeownership rates and compare them to state and nationwide trends.

Kaufman County TX Sales Tax Rate The current total local sales tax rate in Kaufman County TX is 6250. This is the total of state and county sales tax rates. History of Tax Rates.

The median property tax on a 13000000 house is 235300 in Texas. Mud1 kaufman county mud 14 0390000 0610000 1000000 mud10 kaufman county mud 2 0155000 0795000 0950000 mud11 kaufman county mud 3 1000000 0000000 1000000 mud2 kaufman county mud 9 na na na. Kaufman collects a 0 local sales tax the maximum local sales tax allowed under Texas law Kaufman has a lower sales tax than 999 of Texas other cities and counties Kaufman Texas Sales Tax Exemptions In most states essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate.

The fee will appear as a separate charge on your credit card bill to Certified Payments. Discover Helpful Information and Resources on Taxes From AARP. Except for County Approved Holidays Questions.

The median property tax also known as real estate tax in Kaufman County is 259700 per year based on a median home value of 13000000 and a median effective property tax rate of 200 of property value. The minimum combined 2022 sales tax rate for Kaufman County Texas is. Property Not Previously Exempt.

Search could not be preformed at this time. Has impacted many state nexus laws and sales tax collection requirements. PO Box 819 Kaufman TX 75142.

The 2018 United States Supreme Court decision in South Dakota v. The Kaufman County sales tax rate is. Your 2021 Tax Bracket to See Whats Been Adjusted.

100s of Top Rated Local Professionals Waiting to Help You Today. Kaufman County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. Contact Information 972 932-6081.

Ad Get In-Depth Property Tax Data In Minutes. The December 2020 total local sales tax rate was also 6250. Mulberry Kaufman TX 75142.

The Tax Office its officers agents employees and representatives shall not be liable for the information posted on the Tax Office Website in connection with any actions losses damages claims or liability in any way related to use of distribution of or reliance upon such information. Vehicle Registration 469-376-4688 or Property Tax 469-376-4689. Please try again later.

Comptrollertexasgovtaxesproperty- tax Page 2 50-212 08-2018. A convenience fee of 229 will be added if you pay by credit card. The Texas state sales tax rate is currently.

Tax Rates Hunt Tax Official Site

7 Ways Small Business Owners Can Save On Taxes In 2022 Reading Eagle

Lake Ray Hubbard Fountains Lake Activities Great Life Lake

![]()

Tax Info Kaufman Cad Official Site

County Approves Budget Lowers Tax Rate Kaufman County

Best Microdermabrasion Facial 2013 By Best Self Magazine Microdermabrasion Facial Best Self Best

Snow Tires That Will Keep You From Sliding Off The Road Top5 Com Snow Winter Driving Travel Insurance

Glar Greater Lewisville Association Of Realtors Tx Lead Generation Real Estate Success Video Marketing Data

Property Values Rising Again In Kaufman County Around Town Kaufmanherald Com

Truth In Taxation Kaufman County

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

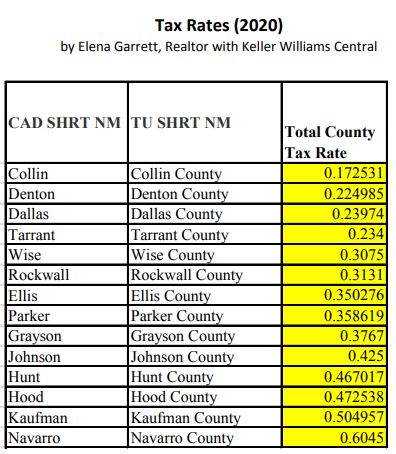

Dfw Tax Property Rates 2020 Elena Garrett Realtor In Dallas Texas My Blog

Skyline Properties Property Real Estate Real Estate Investing Investment Services

Forney Isd Proposes 9 5 Cent Lower Tax Rate Announces 70 Million Under Budget On Construction Projects Education Inforney Com

Dallas Property Tax Property Tax Tax Consulting Dallas

Tax Information Independence Title

Angela Kaufman Century 21 Award Angela Kaufmanpg Com Www Kaufmanpg Com 949 939 7925 01911411 Happyhalloween Mission How To Get Stone Ridge You Got This